The Customer Experience in the UK Retail Industry

Paul Modaley

Download a handy, condensed version in PDF format now!

Download Retail Quick Take Report

The Reputation Data Science team analysed thousands of customer reviews on Google across more than 2,300 locations of the UK’s biggest retail brands.

We’ve ranked some of the biggest high street retailers in the UK using our proprietary Reputation Score during a year that has so far been characterised by post-pandemic uncertainty, international conflict, and a cost-of-living crisis. We found that:

- The majority of customer sentiment is positive with 75% of customers expressing satisfaction with the customer experience at retailers. To take advantage of this trend, retailers should maximise review volumes by actively requesting customer reviews as an intrinsic part of the customer experience.

- 12% of reviews are neutral in sentiment while 13% of reviews are negative. Retailers must delve into what drives negative sentiment to be able to make operational improvements that enhance the customer experience.

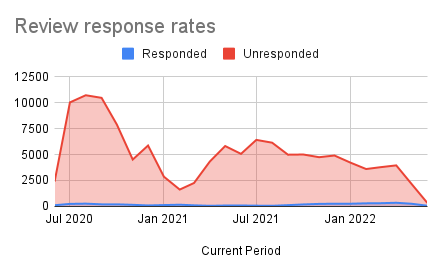

- Generally, retailers are failing to respond to customer reviews with 95% of Google reviews left ‘unresponded’.

- The response rate to reviews from high street retailer brands has improved only slightly since the previous year with 2022 seeing review response rates increase from 3% to 5%.

- Reviews and review responses make a huge difference in building a strong reputation overall. The retail groups with the highest Reputation Scores accumulate more reviews than the laggards and are responding more to their reviews.

Such data indicates that retail brands in the UK are slowly undertaking a digital transformation that is taking place in other industries.

Engaging with customers online through online reviews, for example, is one of the many ways retail brands can improve their reputation and ultimately increase customer acquisition, drive footfall and boost market share.

Find out how the UK’s high street retail brands rank according to their Reputation Score here.

The State of the UK Retail Industry

The retail industry in the UK comprises over 300,000 outlets and some of the nation’s most-loved brands. The sector provides 8% of jobs in the country and generates around 5% of GDP. In 2021, retail sales were in excess of £430 billion.

Challenges and Opportunities Ahead

Many in the retail industry may have breathed a sigh of relief as COVID19-related restrictions were all but done away with and the UK government announced that the country must ‘learn to live with Covid’.

However, new challenges and opportunities have emerged that present significant barriers to growth and even survival for high street retailers, including:

Supply Chain Disruption

Supply chains continue to be stretched by a multitude of factors including a shortage of haulage drivers, squeezed warehouse spaces, and EU bureaucracy in a post-Brexit world. High Street retailers are among the industries most affected by supply chain failure.

Cost of Living Crisis

Inflation combined with high taxes is squeezing the consumer’s purchasing power resulting in a substantial drop in UK retail sales. With consumers being more price-sensitive than ever, retailers must innovate and deliver a top-notch customer experience if they are to persuade consumers to part with their hard-earned money.

Working From Home

High Street retailers have seen a significant decline of footfall since the COVID-19 lockdowns of 2020 and continued home-working means that footfall shows no signs of returning to pre-pandemic levels. With workers opting to stay at home rather than attend offices near high streets, retailers may experience fewer sales from impulsive lunch-time shoppers popping into a local branch of their favourite retailer.

Despite the downturn in footfall, the new working-from-home culture may give rise to new shopping habits and buying patterns, including increased customer dwell time.

Evolving Consumer Attitudes and Behaviour

The growth of the internet continues to shape consumer attitudes and behaviours with many retail customers taking a more sophisticated, less linear approach to shopping which usually begins online before it concludes at a physical store.

Retailers that optimise their ‘digital front doors’ are those who are most likely to capitalise on the new shopper journey. Moreover, retailers must invest in improving the customer experience to drive brand loyalty at a time when consumers have more choices than ever before.

According to Kyle Monk, Director of Insight at the British Retail Consortium (BRC), “customer experience is more important than ever, so brands will have to work harder to emotionally engage with consumers and retain loyalty”.

Retail brands that look to enhance the customer experience to drive brand loyalty, perhaps by responding to customer reviews or communicating with customers through their preferred channels, for instance, are those that are more likely to thrive in a particularly tough business climate in 2022 and beyond.

What Does The Data Reveal About the Retail Customer Experience?

With customer experience being a key factor in the growth and survival of UK retail brands, it is imperative that senior leaders at retail companies understand the reviews and ratings trends on Google. Reviews and ratings on Google are a significant source of unstructured data that can indicate key trends and consumer demands.

To illustrate and explain customer experience trends contained within Google reviews and ratings, the Reputation Data Science team examined more than 55,000 customer ratings/reviews using our own proprietary data analysis methodology. Here’s what we found:

With customer experience being a key factor in the growth and survival of UK retail brands, it is imperative that senior leaders at retail companies understand the reviews and ratings trends on Google. Reviews and ratings on Google are a significant source of unstructured data that can indicate key trends and consumer demands.

To illustrate and explain customer experience trends contained within Google reviews and ratings, the Reputation Data Science team examined more than 55,000 customer ratings/reviews using our own proprietary data analysis methodology. Here’s what we found:

A Rollercoaster of Review Volumes

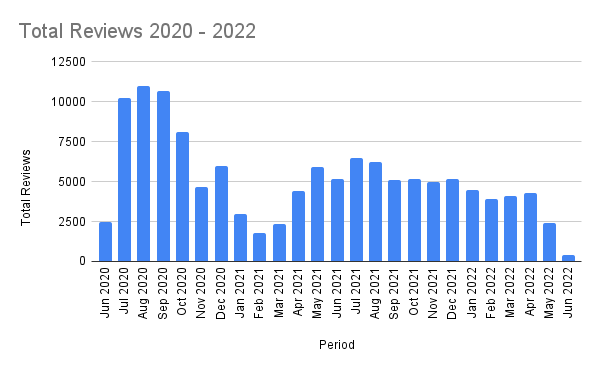

Overall review volumes have understandably fluctuated a great deal in the past two years due to high street closures during successive ‘lockdowns’ and various crises.

In the past year, high street retail review volumes have declined across the 2,363 locations from a total of 73,500 in 2020-2021 to 55,200 at the time of writing in 2021-2022.

Although review volumes are fluctuating and are yet to reach similar levels to the peak year of 2019, the fact remains that online reviews are a very important component of a brand’s online presence. Consequently, with the customer journey beginning online, it is imperative that operators of brick-and-mortar retail stores prioritise review requesting and responding. After all, 79% of shoppers trust online reviews as much as personal recommendations.

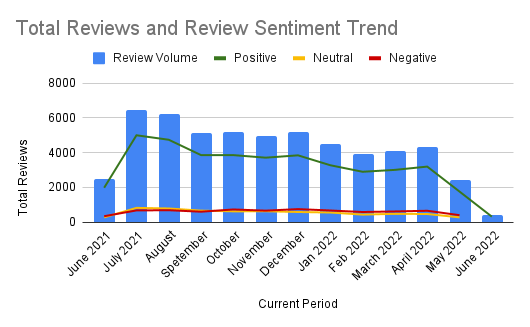

Review Sentiment Is Mostly Positive

The majority of customers who have left reviews about their high street retail experiences during the past year are satisfied or pleased. This is a testament to the sterling work of retail brands during times of unprecedented disruption and challenging economic circumstances.

To make the most of the positive review sentiment, Britain’s high street retail brands ought to ensure that review requests become an integral and seamless part of the customer experience. Review requesting would minimise missing out on reviews which serve to enhance a brand’s online presence and visibility in local search listings, including Google’s local 3-pack. Reputation research shows that having 50 or more negative or positive reviews can boost your search rank by 50% and your click-through rates by 266%, compared to companies with no reviews.

Related resource: How to Ask Customers for Reviews

I am so disappointed in **** *****; I always held your customer service in such good regard but over the last couple of years it has been a nightmare at such a stressful and difficult time. I hope someone from **** ***** may see this review and want to help me with my complaints. But I know this is unlikely.

We would definitely recommend this service and particularly these knowledgeable ladies to anyone who find shopping for that special outfit a daunting task.

My favourite shop. Plenty of choice. Great bargains!

Retailers Are Not Responding To Reviews

The response rate to reviews from retailers is alarmingly low with just 3% of customer reviews on Google receiving a response in the previous two years. This response rate is considerably lower than in other industries, including healthcare, automotive and hospitality.

Lower response rates across the industry present an opportunity for the more savvy retail brands attuned to the new customer journey. By responding to customers’ positive and negative reviews on Google, retailers can build trust with consumers, resolve customer pain points, incentivise additional purchases and store visits, and foster brand loyalty. Considering that 97% of review readers also read the business’ response to reviews, review response ought to become a priority for retail businesses looking to get ahead of the competition.

Moreover, 5 out of the 15 retail brands in our Reputation rankings, have review response rates above 50%. These higher response rates are critical to generating a higher overall Reputation Score which is not only a signifier of brand health but also correlates strongly with revenue.

Related resource: 8 Tips for Responding to Negative Reviews

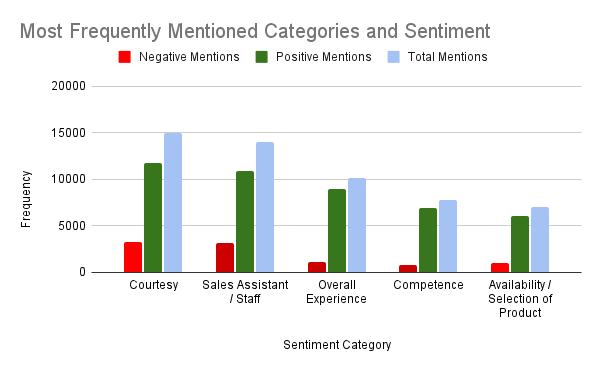

Retail Staff Make The Difference When It Comes To Customer Satisfaction

Using Natural Language Processing (NLP), Reputation’s ‘Experience’ module is able to delve into the sentiment contained within customer reviews to reveal what customers on the high street value most from a retail brand.

Amongst the most commonly mentioned categories of words were ‘staff/sales assistant’, ‘competence’ and ‘courtesy’. These categories being mentioned so frequently strongly suggests that customers place importance on well-trained store personnel above all else. Furthermore, ‘staff/sales assistant’ and ‘courtesy’ were mentioned more often in both positive and negative contexts than any other words further reinforcing the notion that a customer’s experience of in-store staff can make or break their experience overall.

In response to these insights, retail brands ought to delve further into online customer sentiment by undertaking a thorough analysis of reviews across a range of channels from social media to Google.

Once trends in the data are identified, brands can address deficiencies in staff training to ensure that staff are more competent. In turn, this ensures brands deliver a better customer experience overall while also boosting star ratings which according to our ‘insights’ module, makes more impact on ratings than any other category.

Top High Street Retail Rankings

Using our proprietary Reputation Score, we have produced a top-10 ranking of high street retail brands. To arrive at a brand’s Reputation Score, we evaluated store locations within each retail brand and aggregated their scores.

| Brand | Reputation Score | Review Sentiment | Review Volume | Review Recency | Review Length | Review Spread | Review Response | Search Impressions | Listing Accuracy |

| Best In Class | 830 | 93.00 | 56.00 | 70.00 | 23 | 56 | 93 | 64 | 54 |

| Industry Average | 366 | 53.00 | 52.00 | 54.00 | 15 | 55 | 20 | 54 | 51 |

| Travis Perkins | 523 | 66.00 | 45.00 | 42.00 | 14 | 47 | 85 | 53 | 40 |

| H&M | 485 | 54.00 | 51.00 | 73.00 | 9 | 52 | 11 | 52 | 49 |

| John Lewis | 471 | 52.00 | 49.00 | 68.00 | 16 | 52 | 19 | 56 | 50 |

| Tesco | 455 | 44.00 | 54.00 | 75.00 | 20 | 55 | 6 | 56 | 55 |

| Zara | 451 | 44.00 | 53.00 | 84.00 | 12 | 54 | 6 | 53 | 43 |

| New Look | 445 | 57.00 | 44.00 | 51.00 | 8 | 49 | 37 | 54 | 53 |

| Boots UK (Alliance Boots) | 442 | 50 | 50 | 53 | 20 | 52 | 12 | 53 | 52 |

| Marks & Spencer | 420 | 51 | 46 | 51 | 14 | 51 | 17 | 54 | 38 |

| Kingfisher | 395 | 30 | 56 | 71 | 24 | 56 | 14 | 52 | 35 |

| Debenhams | 388 | 50 | 42 | 1 | 10 | 49 | 55 | 54 | 49 |

What does it take to be a top UK retail brand?

Generally, brands with higher review volumes and review sentiment scores performed better than those with lower scores.

Travis Perkins, as the top-ranked brand in our analysis, far outperforms the other brands when it comes to review response and this puts the brand ahead despite them not having the highest scores in other categories.

Many retail brands could climb the ranking quickly by improving review response rates.

Amidst the cost-of-living crisis, supply chain disruption and unprecedented changes to consumer behaviour, retail brands can get ahead of the competition by:

- Managing online reputation closely and proactively to enhance their digital front doors to attract customers online where the customer journey begins

- Requesting, understanding and responding to feedback from customers (both good and bad)

- Managing feedback data across multiple channels to drive improvements at stores

Get started

Undertaking digital transformation in your company can seem overwhelming but don’t fret – our Reputation Experience Management (RXM) Guide is here to help professionals in the retail industry. Access the guide to gain insight into the actions you can take today to enhance your brand’s online reputation and customer experience to boost business performance overall.