Your Financial Services Firm’s Reputation May Be on the Line

Adam Dorfman

Recent research from Marqeta shows that Millennial consumers are less brand-loyal to their banks than Baby Boomer consumers. There are several reasons for this. They include the rise in new financial technologies and the ubiquitous nature of smartphones. However, it highlights the importance of ensuring that you have strong brand loyalty in order to stand out.

While consumer perception is vital for the success of your financial services firm, the shifts in this industry have also opened up some opportunities. The right online reputation management software can help your company retain clients and attract new consumers to your door.

Public Perception and the Financial Services Industry

Things changed quickly for the financial services industry in the wake of the 2008 financial crisis. When the Great Recession hit, and many consumers struggled with job losses and other financial difficulties. In 2020, there were more than 700,000 bank account switches across the UK.

In the last few years, financial services has been recognized as the least trusted industry according to Edelman. Public perception of the financial services industry began to suffer immensely, and it’s proven to be an uphill battle to improve brand perception.

Related: Online Reputation Management for Financial Service Firms

When it comes to your company’s reputation, the stakes are high. In 2017, Equifax allowed thieves to steal more than 140 million consumer Social Security numbers and other sensitive identifying data. This breach rocked the credit reporting and financial services industries. It also put the company in the position of having to rebuild trust with consumers.

On top of this, customer wants and needs have shifted within the industry. According to that Marqeta survey, just one in six Millennials consider themselves completely loyal to their current banking partner. That’s opposed to 48% of survey respondents that would consider moving to digital-only bank.

Why Reputation Management Should Be a Priority

Digital has an increasing influence on how many consumers are making key financial decisions. This ranges from choosing a bank, broker or investment advisor. According to Google, a majority of consumers are now forgoing the sit-down meetings with financial advisors for wealth management decisions.

Related: 6 Stats that Highlight the Importance of Reputation Management in Finance

More than half of offline investors do online research first. And most (86%) will do online research for an hour or more. In fact, Google searches for “financial advisor” have shot up 75% in just two years. Of particular note is that over half of searchers don’t have a brand in mind when searching for financial services.

While the landscape of the financial services space is slightly different, the good news is that this presents some opportunities. Remember that consumers are looking for a combination of the most trustworthy provider and the best deal. Your company can come out on top with effective online reputation management (ORM).

Reputation Management for Financial Services

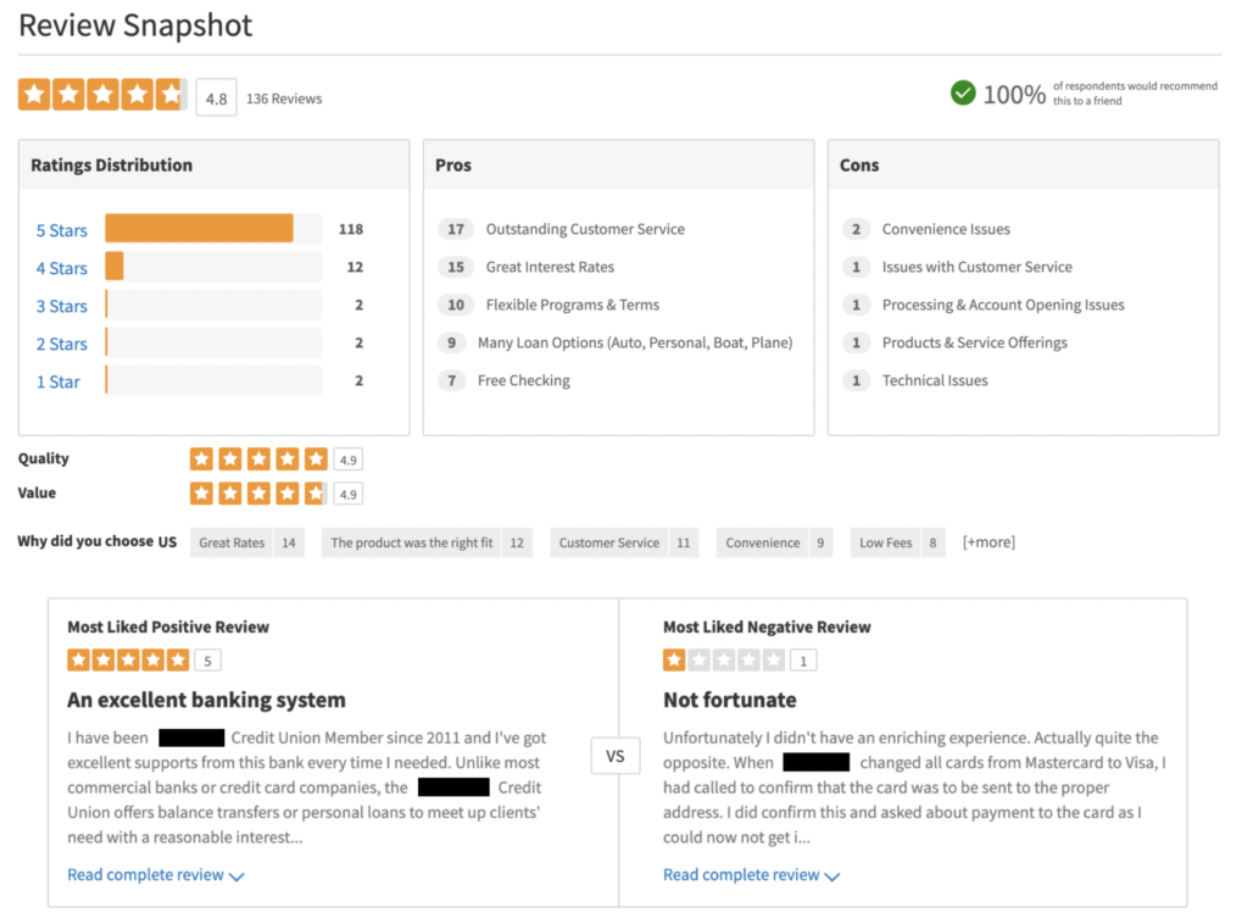

Source: Power Reviews

Managing your online reputation has become a critical component of running a successful financial services organization. When financial consumers are in decision-making mode, the quality of your online presence will make a difference. Keep in mind that ORM has three main components:

- Ensuring your business gets found by the right consumers by improving your performance on search engine results pages.

- Encouraging those who do choose your business to leave reviews. Make sure you close the loop by responding to all feedback provided — even the negative reviews.

- Taking action on customer feedback to improve business operations and get better.

Here are some key areas to consider.

Related: Why Online Reputation Management Matters to Mortgage Lenders

- Online Reviews: You can inspire confidence and trust with an effectively managed online review program. As consumers research their options, they will be looking at your online reviews. Remember that only having five-star reviews will come across as fake. So, you want a healthy mix of positive reviews and less-than-sterling feedback. But remember, it’s all about your response to that feedback, whether it be positive or negative. 70% of consumers changed their opinion about a brand after they received some type of response to the review that they left.

- Business Listings & Directories: Accurate and consistent information about your business in business listings and directories will ensure that your business is findable in specific and “near me” searches. This will help attract new customers within your target audience.

- Surveys: Send automated brand perception surveys in order to directly find out how your customers feel. The customer feedback data you collect customer feedback can boost your review volume and ratings.

- Competitive Intelligence: Understand where your customers are excelling and where they have room for improvement. Strategically use that data in order to improve your customer experience. That will ensure that consumers will pick you over the competition every time.

- Social Listening: Your team can leverage social listening monitors in order to identify trends, track customer sentiment, and mitigate potential crises. That way, you can better engage with your customers and improve their overall experience. That will inevitably give you tips for ways to improve your online reputation.

- Insights: Leverage a tool like Reputation’s in order to bring both public and private feedback together in one spot. That will allow you to gain actionable insights into the complete view of your customer experience, showing where you have room for improvement.

Online reputation management is not something your financial services company can afford to ignore. Fortunately, there are comprehensive and simple tools that can put you in the driver’s seat.